Gitcoin Grants Surviving Crypto Crash So Far, According to Program Lead Annika Lewis

The recent crash in crypto prices hasn’t yet hurt Gitcoin Grants ability to raise funds to help startups, according to grants program lead Annika Lewis

The sharp downturn in the value of cryptocurrencies hasn’t yet dented the ability of Gitcoin Grants to raise money, according to grants program lead Annika Lewis.

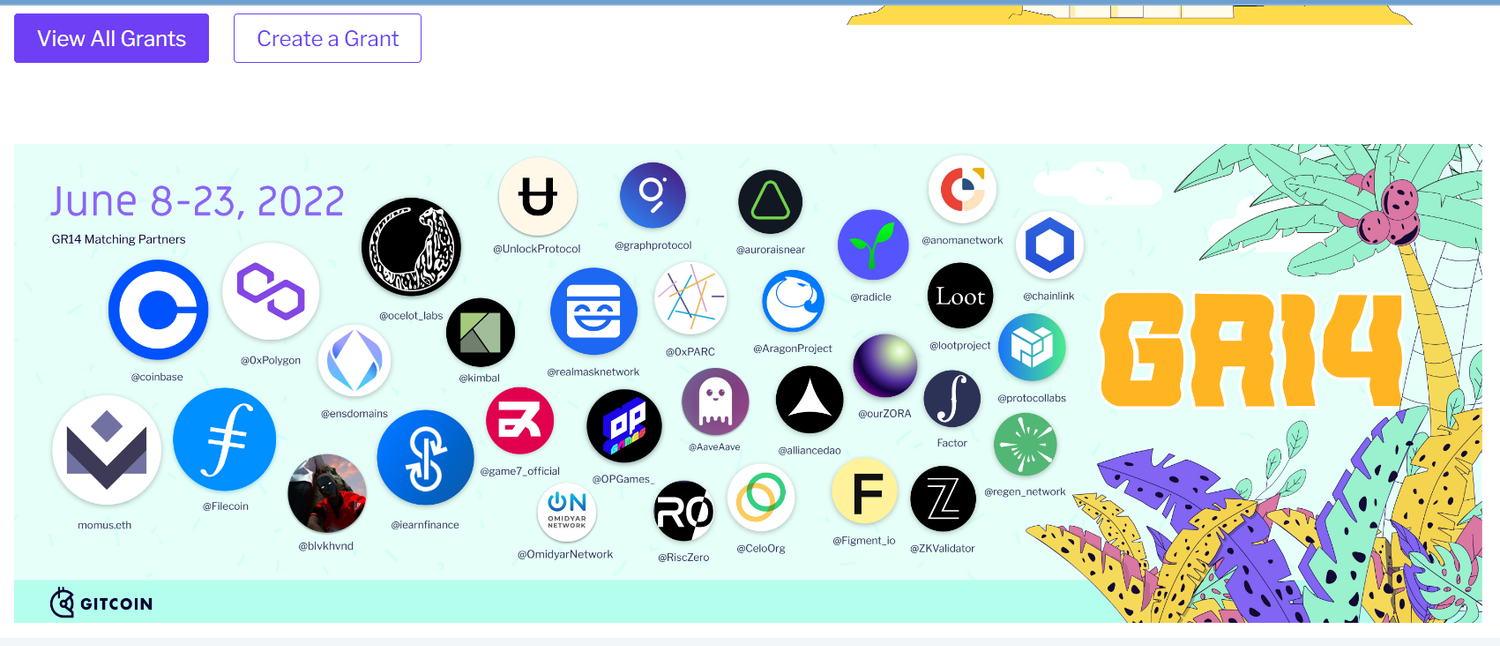

Gitcoin helps web3 startups and social causes receive funding that relies on community voting to identify areas in need of development. Over 14 rounds that each last three months, more than $50 million has been distributed through the platform. Winning projects receive matching funds from established crypto firms such as Coinbase, Uniswap, The Graph Protocol, Chainlink and many others that Gitcoin calls funders.

“What I’ve seen this quarter, I’ve been extremely encouraged so far,” Lewis said. “We expected to see a little bit more hesitation on behalf of the large funders to fund grants given where the market is headed, and we haven’t seen that pan out yet.”

The current Gitcoin Grant round ends June 23 and has raised just over $3 million in matching funds. Its largest round came in December when $6 million was raised. Lewis said she doesn’t have a favorite Gitcoin grantee but that the story of Uniswap stands out.

The peer-to-peer decentralized exchange is the largest in the world and has processed over $1 trillion in transactions. While now it provides matching funds to projects, Uniswap started as a Gitcoin grantee.

Gitcoin funders

“That’s a really nice full-circle story,” Lewis said. “I’m hopeful that in this bear market we’ll see the next Uniswaps born and built using Gitcoin grants, and that they will then come back and fund public goods.”

There has always been a conundrum at the heart of decentralized projects – how do they continue to raise funds over the years it can take to build out projects, fully develop software or get a protocol to be widely adopted. In early crypto the idea was that projects would issue their own tokens with the proceeds fueling their progress. While the initial coin offering craze of 2017 helped many raise funds, it was a honey pot for scams, outright fraud and projects that didn’t deserve $100 million valuations.

So it may seem odd that an old-school system like grants is supporting many of the most cutting-edge computer science innovations in web3 and beyond.

Quadratic Funding

This being crypto, however, the Gitcoin grant system is not as straightforward as it could be. It uses quadratic funding, a math-based system that favors the number of contributors to a project over total amount pledged, which “pushes power to the edges, away from whales & other central power brokers,” according to the charmingly named web site WTFISQF.com.

“The idea behind quadratic funding is that it favors the choices and the preferences of the poor and the many, as opposed to the rich and the few,” Lewis said.

Projects that fall under “cause rounds” are a newer addition to Gitcoin grants, such as efforts to combat climate change or support diversity efforts. While there are digital projects that qualify as cause rounds, the category is appealing to many real-world firms new to crypto that need funding no matter where it comes from.

“One new funder we have in this round for the climate round is Kimbal Musk,” Lewis said, referring to Elon’s brother and founder of Big Green DAO and The Kitchen Restaurant Group. “Kim, as a philanthropist, is really interested in experimenting with novel funding mechanisms,” she said.

Lewis spent about a decade in traditional finance before making the leap into web3, which came in a roundabout way. She was at a venture capital firm and before that worked for Capital One in New York and Toronto. She first heard about crypto in 2016 while working for an innovation team at Capital One, but the exuberance, grift and fraud from the 2017 ICO craze left her jaded.

“I basically forgot about crypto for a few years,” she said.

By 2020, however, she was back and much more impressed with he decentralized finance, or defi, projects that left her “convinced it was the future,” she said.

“In trying market times like this it’s about going back to your core beliefs and the reason that you are here,” Lewis said. “The hope is that we can build a new world here and since we’re starting to set these precedents early on the hope is that we can build an economy that looks different and that isn’t necessarily reflective of what we see in the traditional financial structures today.”